Top 10 Tips To Evaluate Data Quality And Sources Of Ai Trading Platforms That Forecast Or Analyze The Prices Of Stocks.

To provide accurate and reliable data it is essential to verify the data and sources that are utilized by AI trading and stock prediction platforms. Insufficient quality data can cause inaccurate predictions as well as financial losses. This can lead to suspicion about the platform. Here are 10 of the best ways to assess the quality of data sources and their reliability.

1. Verify data source

Be sure to verify the source: Ensure that the platform has data from reliable sources (e.g. Bloomberg, Reuters Morningstar or exchanges like NYSE and NASDAQ).

Transparency: The platform should be transparent about the sources of its data and update them regularly.

Beware of dependencies on a single source: A reliable platforms often aggregate data from multiple sources to minimize the chance of errors and bias.

2. Examine the freshness of data

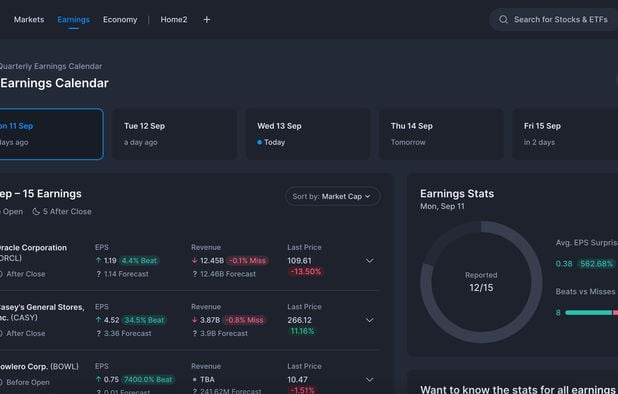

Real-time and. Delayed Data: Find out whether the platform offers real-time information or delayed information. Real-time trading needs real-time data, whereas delayed data will suffice in long-term analysis.

Check the update frequency (e.g. minute-by-minute updates, hourly updates, daily updates).

Historical data accuracy: Make sure that the information is accurate and consistent.

3. Evaluate Data Completeness

Check for missing or inaccurate data.

Coverage: Make sure whether the platform you are using supports an extensive range of indexes and stocks that are pertinent to your plan.

Corporate actions: Make sure that your platform takes into account dividends and stock splits in addition to mergers and other corporate events.

4. Accuracy of Test Data

Cross-verify your data: Check the data of your platform against other trusted sources.

Search for errors through examining excessive financial data or outliers.

Backtesting: Use data from the past to test trading strategies back and check whether the results match with expectations.

5. Assess Data Granularity

The level of detail you are looking for - Make sure you can find the most precise information, such as intraday volumes and rates, bid/ask spreads as well as ordering books.

Financial metrics - Check to see whether there are financial metrics in a comprehensive statement (income statements, balance sheets, cash flows) and key ratios (P/E/P/B/ROE etc.). ).

6. Make sure that Data Cleansing is checked and Preprocessing

Normalization of data: Make sure the platform normalizes the data (e.g., adjusting for splits, dividends) to ensure that the data remains consistent.

Outlier handling: Check the way the platform handles anomalies and outliers.

Estimation of missing data: Make sure that the system relies on reliable methods for filling in the missing data.

7. Examine data consistency

Align all data with the same timezone. This will eliminate any discrepancies.

Format consistency: Make sure that the data is presented in a consistent manner (e.g. currency, units).

Cross-market consistency: Verify that the data from various exchanges or markets is consistent.

8. Determine the relevancy of data

Relevance in trading strategy. Ensure that the data corresponds to your style of trading.

Features Selection: Find out whether the platform has pertinent features, like sentiment analysis, economic indicators and news information which can improve the accuracy of your predictions.

Check the integrity and security of your data

Data encryption - Ensure that your platform is using encryption to safeguard the data when it is transferred and stored.

Tamper-proofing: Make sure that the data isn't manipulated or changed by the platform.

Check for compliance: Make sure that the platform you are using is compatible with any laws governing data protection (e.g. GDPR, the CCPA).

10. Test the Platform's AI Model Transparency

Explainability: Ensure that the platform gives you insights into the AI model's use of data in making predictions.

Verify if there's an option to detect bias.

Performance metrics: Evaluate the track record of the platform and the performance metrics (e.g., accuracy precision, recall, etc.)) to determine the accuracy of its predictions.

Bonus Tips

Reviews and reputation of users Review user reviews and feedback to assess the reliability of the platform and its data quality.

Trial period. You can use the trial period to explore the features and data quality of your platform prior to deciding to purchase.

Customer support: Make sure your platform has a robust support for problems related to data.

Following these tips will enable you to analyze the data quality, the sources, and the accuracy of stock prediction systems based on AI. Check out the best https://www.inciteai.com/ for website recommendations including ai trade, stock ai, ai for stock trading, best AI stock trading bot free, AI stock, investment ai, AI stock trading app, best ai trading app, ai investing app, ai investment app and more.

Top 10 Tips On Assessing The Regulatory Compliance Of AI stock Predicting/Analyzing Trading Platforms

When looking at AI trading platforms, regulatory compliance is a crucial aspect. Compliance ensures that the platform works within the legal framework, safeguards personal data of its users and adheres to the financial laws, which reduces the possibility of legal problems or financial sanctions. These are the top ten suggestions for assessing compliance with regulatory requirements.

1. Verify the licensing and registration

Regulators: Confirm that the platform is licensed and registered by the appropriate financial regulatory body (e.g. SEC, FCA, ASIC, etc.) in your country.

Check that the brokers included in the platform are licensed and monitored.

Public records: Go to the regulatory body's website for the platform's registration status and any previous violations.

2. Look for data privacy Compliance

GDPR: If you are operating or serving users within the EU Make sure your platform is in compliance to the General Data Protection Regulation.

CCPA -- California Consumer Privacy Act: Verify compliance of California users.

Policies on handling data: Read the platform's data privacy policy to determine the methods by which data from users are collected, stored, and shared.

3. Review Anti-Money Laundering(AML) Actions

AML policies - Make sure that your platform's AML policies are effective and effective in detecting and prevent money laundering.

KYC procedures: Verify that the platform adheres to Know Your Customer (KYC) methods to confirm the identities of users.

Monitoring transactions: Find out if the platform monitors transactions for suspicious activity, and then reports it to the appropriate authorities.

4. Make sure you are in compliance with Trading Regulations

Market manipulation: Ensure that the platform is equipped with measures to stop market manipulation such as swap trading or spoofing.

Types of orders. Check that the platform complies with all regulations regarding order type (e.g. there's no stop loss hunting that is illegal).

Best execution: Verify that the platform follows best execution practices to ensure trades are executed for the best price.

5. Examine the level of Cybersecurity Compliance

Data encryption: Ensure that the platform uses encryption to protect data while in transit or at rest.

Incident response. Verify that there is clearly identified incident response plan for the platform for cyberattacks as well as data breaches.

Make sure to check for the certifications.

6. Transparency and disclosure A Study

Fee disclosure: Ensure the platform is clear about the total amount of fees, which includes hidden or additional charges.

Risk disclosure: See if there are clear disclosures of risk, particularly in high-risk or leveraged trading strategies.

Performance reports - Check to determine if there are precise and transparent reports on performance that are provided by the platform for its AI models.

7. Verify the conformity to International Regulations

Transborder trade If you plan to trade internationally make sure your platform is legal with all applicable laws.

Tax reporting: Verify whether there are any tools or reports available to assist you in complying with tax laws.

Sanctions compliance - Ensure that the platform adheres to international sanctions and doesn't allow trading only to countries or entities prohibited.

8. Review Audit Trails and Record-Keeping

Transaction records: For regulatory and auditing purposes, ensure that the platform maintains detailed logs of all transactions.

User activity logs: Check if your platform keeps track of all activities by users, including logins, transactions, and the changes to account settings.

Audit readiness: Ensure the platform has all of the documentation and logs necessary to be able to pass a review by a regulator.

9. Evaluate Compliance with AI-Specific Regulations

Algorithmic Trading Rules If your broker supports algorithmic trading, ensure it complies with rules such as MiFID II (in Europe) or Reg SCI (in the U.S.).

Fairness and impartiality: Check the accuracy of the platform's AI models are monitored and adjusted to avoid bias.

Explainability: Ensure that the platform has clear explanations of AI-driven decisions and predictions as required by certain laws.

10. Review feedback from users and regulatory history

User reviews: Use user feedback to determine the platform's compliance with regulations.

Review the regulatory history to see whether any violations of the regulations have been committed, and also penalties and fines.

Third-party checks: Check the platform's compliance with the law by checking if it undergoes periodic audits from third party.

Bonus Tips

Legal consultation: Talk to an expert on the subject to verify if your platform is in compliance with the regulations.

Trial period. Try the trial or demo version of the platform to try out its compliance features.

Support for customers: Make sure that the platform can provide support to customers with questions or concerns related to compliance.

With these guidelines you can identify the level of compliance with regulations among AI stock trading platforms. This will allow you to choose a platform which is legal and will protect your interests. Compliance does more than reduce legal risks, but also improves trust with the platform. See the top rated best ai for stock trading examples for more tips including ai options trading, investing with ai, best ai trading platform, stock trading ai, best AI stocks, how to use ai for copyright trading, how to use ai for copyright trading, ai software stocks, stock trading ai, chart analysis ai and more.

Comments on “20 Top Pieces Of Advice For Picking AI Stock Analysis Sites”